First Time Home Buyer Guide

Is now a good time for you to buy a home?

Determining the right time to buy versus rent a property is a decision that requires careful consideration of various factors. Financial stability, long-term plans, market conditions, and personal preferences all play a role in this decision-making process. Buying a property can provide stability and the potential for building equity over time, especially if you plan to stay in the same location for an extended period. It offers the freedom to personalize your living space and potentially benefit from property appreciation. On the other hand, renting provides flexibility and lower upfront costs, making it an attractive option for those who value mobility or are uncertain about their long-term plans.

What should I do to prepare to buy?

- Determine your financial readiness: Assess your current financial situation. Review your income, savings, and monthly expenses. Consider your credit score and debt-to-income ratio, as these factors will affect your ability to secure a mortgage.

- Save for a down payment and closing costs: Start saving for a down payment, which is typically a percentage of the home's purchase price (commonly 10-20% of the total). Additionally, you'll need to cover closing costs, which can range from 2% to 5% of the purchase price.

- Establish a good credit score: Lenders consider your credit score when determining your eligibility for a mortgage and the interest rate you'll receive. Pay your bills on time, reduce your debt, and avoid taking on new credit obligations.

- Get pre-approved for a mortgage: Contact multiple lenders to get pre-approved for a mortgage. This process involves providing your financial information and having the lender evaluate your creditworthiness. Pre-approval gives you an idea of the loan amount you can qualify for and helps you narrow down your home search.

- Determine your housing needs and preferences: Make a list of your desired features in a home, such as location, size, number of bedrooms and bathrooms, amenities, and proximity to schools or workplaces.

- Consider your long-term plans, such as relocation, family expansion or potential changes in employment.

- Research the housing market: Study the real estate market in your desired location. Monitor property prices, market trends, and inventory levels.

Benefits to buying a home

- Equity and Investment: When you purchase a home, you start building equity as you pay down your mortgage. Over time, your home's value may appreciate, allowing you to accumulate wealth and potentially make a profit if you decide to sell it later.

- Stability and Security: Homeownership provides a sense of stability and security, as you have control over your living space.

- Personalization and Freedom: As a homeowner, you have the freedom to personalize your space according to your preferences.

- Tax Benefits: Homeownership often comes with tax advantages. In many countries, mortgage interest and property tax payments are tax-deductible, which can lower your overall tax burden.

- Long-term Cost Savings: While buying a home involves upfront costs, such as a down payment and closing costs, over the long term, owning a home can be more cost-effective than renting. As you pay down your mortgage, your monthly housing costs become a form of forced savings and may be lower than rental payments for similar properties.

- Potential Rental Income: If you have extra space or decide to move out of your home in the future, you can consider renting it out. This can provide you with additional income and potentially help you cover your mortgage or other expenses.

- Pride of Ownership: Owning a home often instills a sense of pride and accomplishment. It allows you to establish roots in a community, build relationships with neighbors, and create a place that reflects your identity and values.

- Potential for Home Equity Loans: As you build equity in your home, you may have the option to take out a home equity loan or line of credit. This can be useful for financing large expenses like home improvements, education, or medical bills, leveraging the value of your property.

- Hedging against Inflation: Real estate has historically served as a hedge against inflation. As the cost of living rises, owning a home can provide a level of protection by potentially increasing in value and keeping pace with or outpacing inflation.

It's important to note that the benefits of homeownership can vary depending on factors such as the local housing market, your financial situation, and your long-term goals. It's advisable to carefully evaluate your circumstances and consult with financial and real estate professionals before making a decision.

Home Buyer Checklist

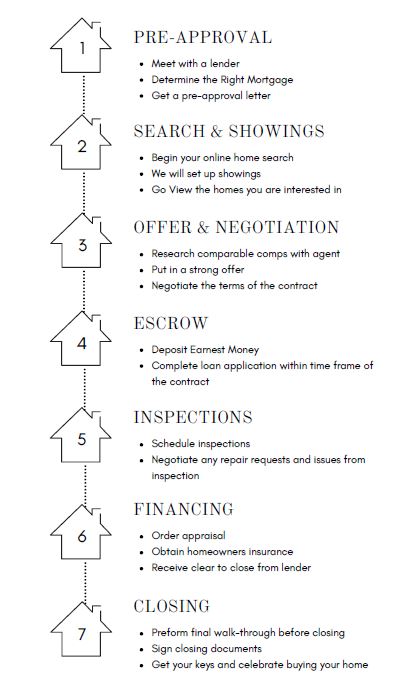

Home Buying Process

Whether your dream home is a new construction or existing home, it helps to know what to look for, and have a plan.

The list below and your Coldwell Banker-affiliated agent will help you conduct a home search, negotiate, and close on a new home.

- Get pre-approved for a mortgage, check your credit report, type of mortgage, shop for best rates and programs.

- Determine your wants and needs: style of home, size, price, location, etc.

- Seek out a Coldwell Banker Residential Brokerage Realtor. Compare the services of different agents and look for good personal chemistry.

- Check out the neighborhoods, schools, crime rate, traffic, zoning, and commuting distance.

- Rely on your Coldwell Banker agent’s expertise and resources.

- Do the due diligence and research on your property of interest.

- Visit or have your agent visit the town or city hall to learn of any zoning changes, liens, easements, or other restrictions.

- Have your sales associate prepare a property value study, and ask the seller if there are any other offers and his motivation for selling, deadlines, etc.

- Conduct home inspections and other inspections.

- Prepare your offer and negotiate.

- Take advantage of the inspection contingencies in your offer and get thorough inspections to eliminate any surprises after you move in.

- Use the inspection report to renegotiate, if necessary.

- Conduct final negotiations.

- Do a walk-through inspection prior to closing.

- Visit your new home one last time before sitting down at the closing table to make sure everything is as you expect it to be.

Recommended Reading For First Time Buyers

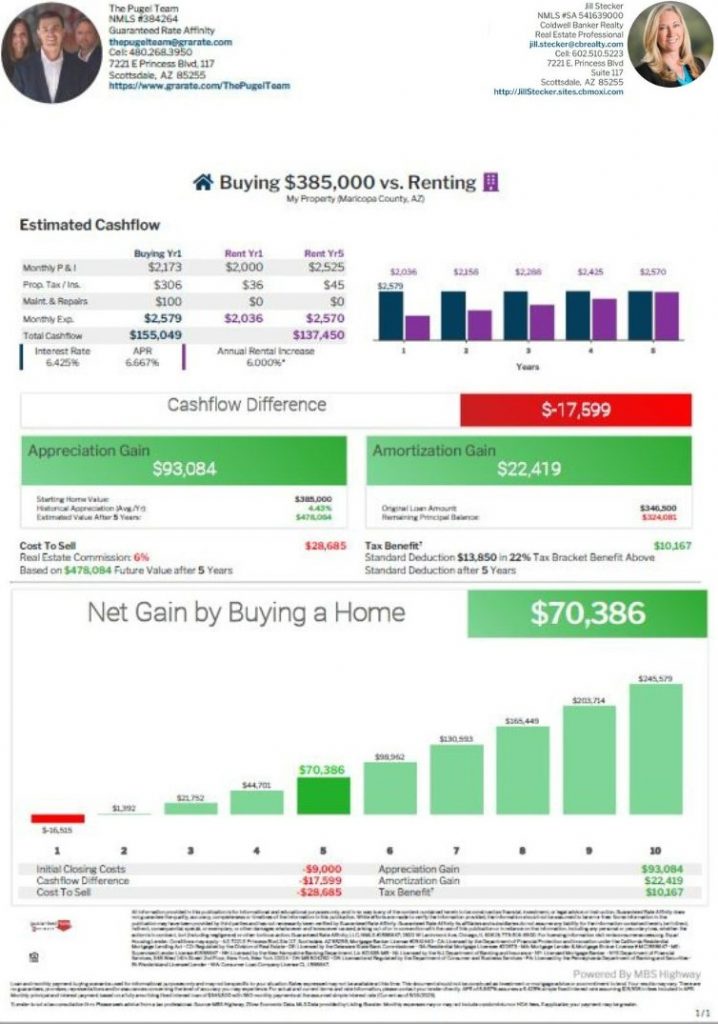

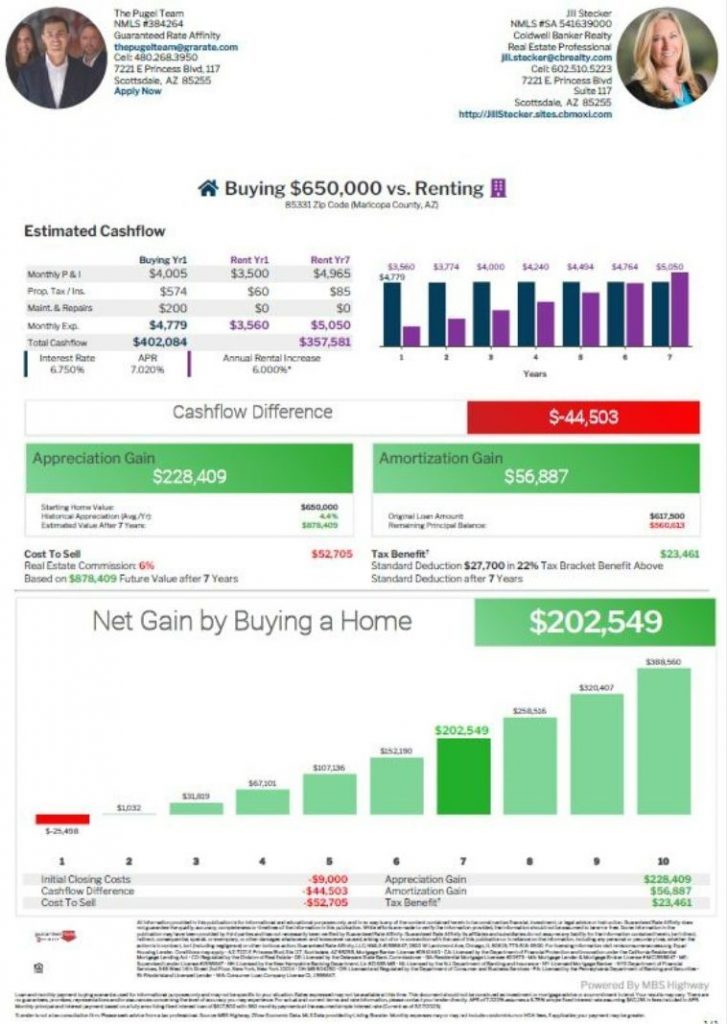

Buying Vs. Renting Cost Breakdown